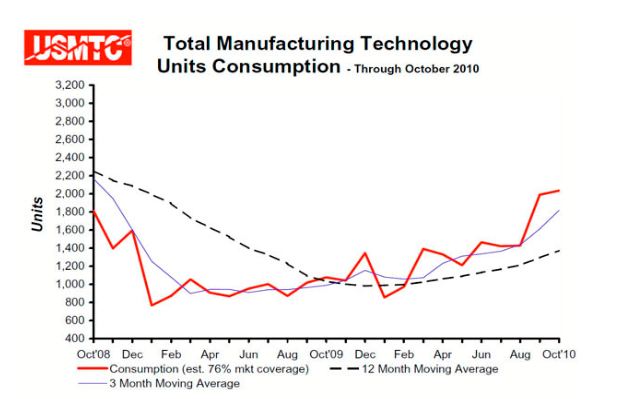

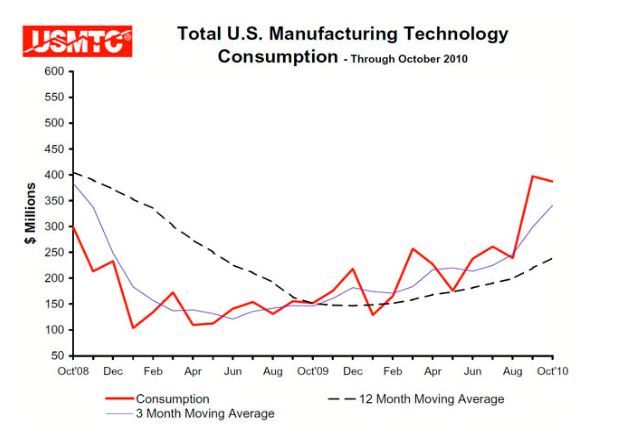

Manufacturing in the U.S. expanded in December at the fastest pace in seven months, reinforcing signs the expansion is gaining momentum.

The Institute for Supply Management’s index climbed to 57 last month from 56.6 in November, the Tempe, Arizona-based group said today. A reading greater than 50 points to expansion, and the figure matched the median forecast of economists surveyed by Bloomberg News.

Stocks rallied, sending benchmark indexes up the most in a month, on speculation U.S. growth will keep strengthening in early 2011, raising prospects for more hiring. Increased spending by American consumers and business investment is helping drive production gains at factories that make up about 11 percent of the world’s largest economy.

“The factory sector is growing at a brisk pace, and it’s getting fueled by both U.S. demand and growth in exports,” said Mike Englund, chief economist at Action Economics LLC in Boulder, Colorado, who correctly forecast the ISM figure. “The economic recovery will get help from manufacturing.”

Former Federal Reserve Governor Frederic Mishkin today said that while the central bank will complete its $600 billion bond- purchase program to help fuel the economy, a third round of so-called quantitative easing is unlikely.

“The fact that the economy is stronger right now makes it much less likely we’re going to see a QE3,” Mishkin, an economist at Columbia University in New York, said today in an interview on Bloomberg Television’s “In the Loop With Betty Liu.”

Click HERE for the video on the interview with Frederic Mishkin, a professor at Columbia University and former Federal Reserve governor.

Click HERE for the video on the interview with Frederic Mishkin, a professor at Columbia University and former Federal Reserve governor.

Professor Mishkin speaking with Jon Erlichman and Michael McKee on Bloomberg Television’s “In the Loop,” also comments on the U.S. economy and outlook for inflation. (Source: Bloomberg)

Stocks Rally

The Standard & Poor’s 500 Index increased 1.1 percent to 1,271.87, its highest close since Sept. 3, 2008, as of 4 p.m. in New York. The benchmark 10-year Treasury note declined, pushing up the yield to 3.34 percent from 3.3 percent late on Dec. 31.

Another report today showed construction spending rose in November for a third month, helped in part by federal government projects. A 0.4 percent gain followed a 0.7 percent increase in October, the Commerce Department said.

The median ISM forecast of economists in the Bloomberg survey was based on 63 projections and estimates ranged from 55 to 60. The U.S. data followed a report that European manufacturing expanded more than initially estimated in December, powered by Germany’s export-led expansion.

A gauge of factory activity in the euro area rose to 57.1 from 55.3 the previous month, London-based Markit Economics said today. That’s higher than the 56.8 reported earlier for December.

China’s Economy

China’s manufacturing growth, meanwhile, slowed in December partly because of tighter monetary policy. A purchasing managers’ index fell to 53.9 from a seven-month high of 55.2 in November, China’s logistics federation and the statistics bureau said Jan. 1.

St. Petersburg, Florida-based Jabil Circuit Inc., which provides manufacturing services, is one company benefiting from stronger emerging economies such as China and India. Jabil said Dec. 20 that its revenue rose $4.1 billion in the three months ended Nov. 30, up from $3.1 billion a year earlier.

“At this point, in terms of U.S. spending, enterprise spending looks stable,” Timothy Main, chief executive officer of Jabil, said on a teleconference with analysts on Dec. 20. “International spending looks very strong and other areas of enterprise infrastructure are pretty robust.”

Orders, Production

In the U.S., factories reported faster rates of orders and production. The ISM’s bookings measure rose in December to a seven-month high.

“Manufacturers are carrying a good bit of momentum into January,” Norbert Ore, chairman of the ISM factory survey, said today on a conference call with reporters. There is “good balance between new orders and production,” and “there’s still some room” for inventory replenishment, he said.

Further gains in manufacturing may come from a pickup in consumer spending, which accounts for about 70 percent of the U.S. economy. Retailers’ 2010 holiday sales jumped 5.5 percent for the best performance since 2005, according to MasterCard Advisors’ SpendingPulse, which measures sales by all payment forms. The gain was 4.1 percent a year earlier. The numbers include Internet sales and exclude automobile purchases.

Auto dealers are also seeing improved demand. Car sales in November rose to a 12.26 million unit pace, the highest since the government’s cash-for-clunkers program in August 2009, according to industry data.

Economists in December boosted forecasts for fourth-quarter growth, reflecting a pickup in consumer spending and passage of an $858 billion bill extending all Bush-era tax cuts for two years. The legislation also continues expanded unemployment insurance benefits through 2011, trims payrolls taxes and includes accelerated tax depreciation for equipment purchases.

To contact the reporter on this story: Shobhana Chandra in Washington at schandra1@bloomberg.net

To contact the editor responsible for this story: Christopher Wellisz at cwellisz@bloomberg.net

Additional interviews on the topic. Please click the picture for the video.

Jan. 3 (Bloomberg) — Drew Matus, senior U.S. economist for UBS Securities LLC, talks about the outlook for the U.S. economy in 2011. Matus, speaking with Deirdre Bolton on Bloomberg Television’s “InsideTrack,” also discusses Federal Reserve monetary policy. (Source: Bloomberg)

Jan. 3 (Bloomberg) — Drew Matus, senior U.S. economist for UBS Securities LLC, talks about the outlook for the U.S. economy in 2011. Matus, speaking with Deirdre Bolton on Bloomberg Television’s “InsideTrack,” also discusses Federal Reserve monetary policy. (Source: Bloomberg)

Dec. 30 (Bloomberg) — Lakshman Achuthan, managing director of Economic Cycle Research Institute, talks about the outlook for the U.S. economy and employment in 2011. Achuthan, speaking with Melissa Long on Bloomberg Television’s “Bottom Line,” also discusses Federal Reserve policy. (Source: Bloomberg)

Dec. 30 (Bloomberg) — Lakshman Achuthan, managing director of Economic Cycle Research Institute, talks about the outlook for the U.S. economy and employment in 2011. Achuthan, speaking with Melissa Long on Bloomberg Television’s “Bottom Line,” also discusses Federal Reserve policy. (Source: Bloomberg)

![P1020386 [800x600]](https://www.cmarshallfab.com/wp-content/uploads/2011/01/P1020386-800x600.jpg)

![P1020380 [800x600]](https://www.cmarshallfab.com/wp-content/uploads/2011/01/P1020380-800x600.jpg)

![P1020378 [800x600]](https://www.cmarshallfab.com/wp-content/uploads/2011/01/P1020378-800x600.jpg)

![P1020377 [800x600]](https://www.cmarshallfab.com/wp-content/uploads/2011/01/P1020377-800x600.jpg)

![P1020372 [800x600]](https://www.cmarshallfab.com/wp-content/uploads/2011/01/P1020372-800x600.jpg)

![P1020369 [800x600]](https://www.cmarshallfab.com/wp-content/uploads/2011/01/P1020369-800x600.jpg)

![P1020348 [800x600]](https://www.cmarshallfab.com/wp-content/uploads/2011/01/P1020348-800x600.jpg)

![P1020368 [800x600]](https://www.cmarshallfab.com/wp-content/uploads/2011/01/P1020368-800x600.jpg)