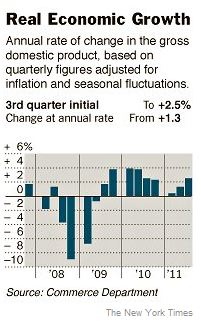

GDP Grew 2.5% In Third Quarter.

The CBS Evening News (10/27, lead story, 3:25, Pelley) reported, “If you were looking for the day the economy began to rise, today could be a contender.” In the first quarter of 2011, the GDP grew 0.4%, while in the second quarter it grew 1.3%. The 2.5% growth is “still weak, but there is a hint of momentum.” Reporter Anthony Mason said the numbers have “eased recession fears for the moment, but it hasn’t erased them.”

The CBS Evening News (10/27, lead story, 3:25, Pelley) reported, “If you were looking for the day the economy began to rise, today could be a contender.” In the first quarter of 2011, the GDP grew 0.4%, while in the second quarter it grew 1.3%. The 2.5% growth is “still weak, but there is a hint of momentum.” Reporter Anthony Mason said the numbers have “eased recession fears for the moment, but it hasn’t erased them.”

ABC World News (10/27, lead story, 3:00, Stephanopoulos) reported, “Signs of life in our economy” were difficult “to miss,” maybe “because we hoped for them so much.” However, “the big question tonight, will this momentum translate into jobs and the comeback America’s been waiting for?” ABC’s Dan Harris said since this summer “we’ve been living in fear of a another sickening, soul-crushing drop back into a recession,” but “the roller coaster appeared to be heading back uphill.”

NBC Nightly News (10/27, story 2, 1:30, Faber) reported that the average American “won’t feel” any effects from Thursday’s numbers announced or rising stocks “for some time, if we feel it at all.” And 2.5% growth isn’t the pace “to actually generate jobs.” However, “it creates confidence in the CEO suite, perhaps.”

In a front-page story, the New York Times (10/28, A1, Dewan, Subscription Publication) reports that Thursday’s new numbers aren’t “brisk enough” to “entirely dispel fears of a second recession,” and Kathy Bostjancic, the Conference Board’s macroeconomic analysis director said the current “growth rate may be hard to sustain,” because CEO and consumer confidence are “starting to melt away.” Meanwhile, David A. Rosenberg, chief economist for Gluskin Sheff, added that “declines in the savings rate” indicated in Thursday’s report, down one percent to 4.1 percent, while rare, “herald recession” at least half the time they occur.

According to the AP (10/27, Crutsinger), the summer’s growth was spurred by consumers “who spent more while earning less and by businesses that invested in machines and computers, not workers.” Still, the numbers are “the best quarterly growth in a year” and they were welcomed after “weeks of wild stock market shifts and the weakest consumer confidence since the height of the Great Recession.”

Bloomberg News (10/27, Kowalski) notes that in the third quarter, “household purchases, the biggest part of the economy, increased at a 2.4 percent pace, more than forecast by economists.” However, Bloomberg’s Consumer Comfort Index fell “to minus 51.1 in the week ended Oct. 23, the lowest in a month,” and 94 percent in the US said they have “a negative opinion about the economy, the worst since April 2009 and one percentage point shy of a record high.”

McClatchy (10/28, Hall) reports that Thursday’s numbers relaxed “the threat of a double-dip recession” and decreased “anxiety over the near-term economic future.”

USA Today (10/28, Davidson) reports that while some like Wells Fargo chief economist John Silvia said the report showed “very broad-based growth,” others like HIS Global Insight’s Nigel Gault said news of increased growth on the back of decreased savings is “not a solid foundation for growth.”

The Financial Times (10/28, Bond, Harding, Subscription Publication) and Wall Street Journal (10/28, A3, Mitchell, Murray, Subscription Publication) also have reports and analyst reaction.

From SME Daily Executive Briefing 10/28/2011