Manufacturing Output Rose In February.

The New York Times /AP (3/18, B3) reports that US manufacturing output rose in February for the sixth straight month in a row, gaining 0.4 percent, according to the Federal Reserve. “Manufacturers have increased production in 17 of the 21 months since the recession ended,” and “stronger factory activity has been an important factor supporting job growth” During February, “factories added 33,000 job.”

Bloomberg News (3/18, Willis) reports that February’s growth “followed a 0.9 percent January gain that was three times as large as initially estimated, Fed figures showed today.” Firms are “benefiting from overseas demand, business investment and inventory restocking that are fueling manufacturing.”

Industry Week (3/18) reports, “The production of durable goods advanced 0.9% in February, and gains were widespread across its major categories.” Motor vehicle production rose 4.2%, and “sizable gains also were recorded in February in wood products; nonmetallic mineral products; computer and electronic products; electrical equipment, appliances, and components; furniture and related products; and miscellaneous manufacturing.”

The “Real Time Economics” blog of the Wall Street Journal (3/17, Lahard) reports that while factories in general are seeing a low level of capacity utilization, textile mills, apparel makers, and producers of computer and peripheral equipment have seen a significant tightening of capacity, although for the first two it’s mostly due to a drop in US productive capacity.

Fed: Philadelphia Area Manufacturing Up.

According to the Philadelphia Inquirer (3/18, Schweizer), the Federal Reserve Bank of Philadelphia reported that, “riding a wave of new orders, manufacturers in the Philadelphia area ramped up production this month to the highest level in more than 27 years,” rising to 43.4 from 35.9 last month. “The strength was broad-based, the Philadelphia Fed said, with manufacturers’ shipments of finished products, unfilled orders, and labor conditions all at high levels.”

Bloomberg News (3/18, Willis) reports, “Rising exports to emerging economies such as China, along business investment and inventory rebuilding are generating bigger gains in factory production.” Industry Week (3/18) reports, “Increases in input prices continue to be widespread, and more firms have been reporting increases in prices for their manufactured goods in recent months. Most firms also indicated that they expect acceleration in production over the next quarter.”

According to the Philadelphia Business Journal (3/18, Kostelni), the indicators “pointed to an uptick in future production activity during the next quarter.”

As Copper Prices Rise, Manufacturers Switch To Aluminum.

The Wall Street Journal (3/18, Whittaker) reports that increasing copper prices have manufacturers turning to aluminum, as the difference in cost of the metals has reached the point that it is greater than the expense of retooling some manufacturing processes as well as the cost of the extra aluminum needed to conduct the same amount of electricity in copper. Wiring for cars and buildings, as well as evaporator and condensing coils for air conditioners and refrigeration are poised to make the switch.

From SME Daily Executive Briefing 3/18/2011

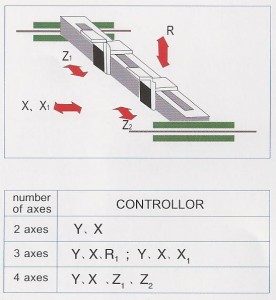

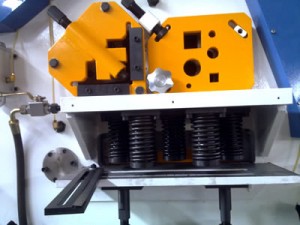

Strong mono block rigid C type body built up by stress relieved welded steel construction has high acceleration axes and designed to allow sheet loading from 3 sides ergonomically and the operation to be watched easily. Sheet processing can be done multi-directional and flexible until 0.2″ thickness. Hydraulic, electronic, electric and mechanic components that are respected with its high quality worldwide have been used on the machine.

Strong mono block rigid C type body built up by stress relieved welded steel construction has high acceleration axes and designed to allow sheet loading from 3 sides ergonomically and the operation to be watched easily. Sheet processing can be done multi-directional and flexible until 0.2″ thickness. Hydraulic, electronic, electric and mechanic components that are respected with its high quality worldwide have been used on the machine. The importance of the pipeline in industry, agriculture and nearly every vital facet of civilization cannot be under-emphasized. Without pipeline construction, we would lack plumbing and electricity, not to mention access to gas & petroleum reserves. But perhaps the pinnacle of modern civilized uses for pipelines can be found in a German town by the name of Gelsenkirchen. The pride and joy of this fair city is a football (European for soccer) stadium known as the Veltins Arena, the self-described “cult temple” of the German football league team FC Schalke 04.

The importance of the pipeline in industry, agriculture and nearly every vital facet of civilization cannot be under-emphasized. Without pipeline construction, we would lack plumbing and electricity, not to mention access to gas & petroleum reserves. But perhaps the pinnacle of modern civilized uses for pipelines can be found in a German town by the name of Gelsenkirchen. The pride and joy of this fair city is a football (European for soccer) stadium known as the Veltins Arena, the self-described “cult temple” of the German football league team FC Schalke 04.