Good news for US economy: Q4 growth revised up, January consumer spending surges

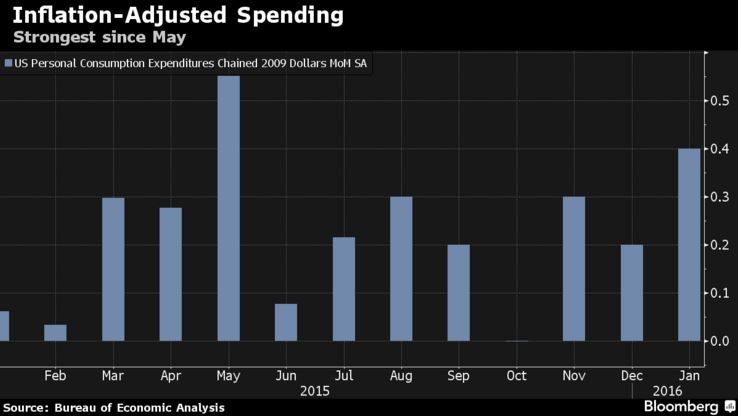

Consumer purchases climbed in January by the most in eight months, fueled by faster earnings growth that’s being accompanied by rising inflation.

The 0.5 percent advance followed a 0.1 percent gain the prior month, a Commerce Department report showed Friday. The January figure exceeded the 0.3 percent median forecast in a Bloomberg survey. Incomes also climbed 0.5 percent, more than projected.

Steady hiring, cheap gasoline, and rising home values are powering Americans’ ability to boost spending, which accounts for almost 70 percent of the economy. The report also showed the Federal Reserve’s preferred measure of inflation rose by the most since October 2014, illustrating the challenge for U.S. central bankers as they consider tighter monetary policy amid feeble global markets.

A separate report from the Commerce Department, also issued Friday, showed gross domestic product expanded at a revised 1 percent annualized rate in the fourth quarter, faster than the previously reported 0.7 percent advance and reflecting a higher value of business inventories.

Projections for January consumer spending ranged from a decline of 0.1 percent to a gain of 0.5 percent, according to the Bloomberg survey. The previous month’s reading was initially reported as unchanged.

Real Spending

The Bloomberg survey median for incomes called for a rise of 0.4 percent, after a previously reported 0.3 percent gain. The January gain was the most since June.

Adjusted for the effect of price changes, spending increased 0.4 percent, the most since May.

Disposable income, or the money left over after taxes, rose 0.4 percent for a second month, after adjusting for inflation. The saving rate held at 5.2 percent. Wages and salaries advanced 0.6 percent following a 0.2 percent increase.

Among other details, household outlays on services rose 0.3 percent after adjusting for inflation. The category, which includes tourism, legal help, health care, and personal care items such as haircuts, is typically difficult for the government to estimate accurately.

Spending Categories

Services spending for last month probably reflected a surge in utility use as colder temperatures returned in January following an unseasonably warm December. A winter storm also blanketed the Mid-Atlantic and Northeast regions with snow late last month.

Spending on durable goods, which includes automobiles, increased 1.1 percent after adjusting for inflation, while outlays for non-durable goods, which include gasoline, rose 0.4 percent.

The Fed’s preferred measure of inflation picked up, the report showed. The price gauge based on the personal consumption expenditures index increased 0.1 percent from the prior month and was up 1.3 percent from a year earlier. Inflation hasn’t reached the Fed’s 2 percent goal since April 2012.

The core price measure, which excludes food and fuel, rose 0.3 percent from the prior month and climbed 1.7 percent from January 2015, which was the most since November 2012.

Fed policy makers are trying to balance concern over market turmoil and slowing overseas economies with signs that U.S. inflation is picking up. They held the target for the benchmark fed funds rate at 0.25-0.5 percent in January after lifting rates at the December meeting for the first time since 2006.

Updated on Bloomberg Business